Featured Stories

-

Revolutionizing Lithium-lon Battery Manufacturing Advances in Slot-Die and Electrode Coating Technology

As the global battery market surges toward an estimated $328 billion by 2028, innovations in manufacturing processes are becoming increasingly... -

Nordson Divisions Collaborate to Achieve Unprecedented Flat Profile Time

Nordson Measurement & Control Solutions (a division of Nordson Corporation) is a global leading provider of gauging systems for the film... -

Preventing Static Defects in Digital Printing

Digital printing has revolutionized document creation.

News | New Products

-

UV Days 2025 by IST Metz to Offer Innovation, Expert Presentations, Networking for Printing’s Future

UV Days 2025, organized by IST METZ, will offer a opportunity for printing-industry professionals to find out about the latest trends and technologies from June 3-5.

-

Vianode Granted Innovation Norway Loan to Strengthen R&D and Global Growth Platform

Vianode, an advanced battery materials company, announces the grant of a NOK 400 million loan commitment from Innovation Norway.

-

Evonik Launches TEGO® Wet 288 for Substrate Wetting of Waterborne and Radiation-curing Formulations

Evonik Coating Additives has developed TEGO® Wet 288, a unique substrate wetting additive designed to address the challenges of waterborne and radiation-cured formulations.

-

Jacob Makola Joins EDGE Industrial Technologies as Director, Global Supply Chain Matt Church Joins Leverwood Knife Works as Plant Manager

Jacob Makola has been hired as Director, Global Supply Chain at EDGE Industrial Technologies (EDGE)

-

Schreiner ProTech Expands HighProtect Series of Pressure Compensation Seals

Ideal for automotive components manufacturing applications, the solutions combine exemplary air venting with robust protection against liquids, dirt and dust.

-

FLAG Announces April Lunch & Learn Event: Variable Data Printing in Labels & Preparing for the Sunrise 2027

Flexo Label Advantage Group LLC (FLAG) announced its upcoming April 2025 Lunch & Learn, taking place Thursday, April 17 at 2:00 PM EST.

-

CT Manufacturer Leads Global Green Packaging Industry

Strong, Sustainable Products Protect Human Lives And the Environment From Toxic Lithium Battery Fires

Expert Advice

Release Liners: A Worldwide Special Report: Release LinersPackaging Waste?

- Published: November 01, 2002, By AWA Alexander Watson Assoc.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5

An opinion shift that release liners are packaging rather than process waste will have consequences across the supply chain.

There can be no question release liners constitute an essential part of the production and application process for self-adhesive labels—but afterward they are thrown away. Whether release liners are classified as “packaging’” waste or simply as “process” waste, there is undoubtedly an ethical issue in relation to their disposal. They are high-value items and often highly engineered, and today—when globally we are concerned with making the most of the world’s dwindling resources—it may well be considered unacceptable that they simply go into landfill.

European Legislation

Europe is ahead of other global regions in addressing this issue and has taken the route of legislation. In 1994 the European Union (EU) issued its first Packaging and Packaging Waste Directive, aimed first at reducing the amount of landfill and incineration without energy recovery (two major global environmental concerns) and second at driving down the levels of waste in the packaging industry as a whole. The directive encourages minimization of the amount of material used in packaging applications, re-use of components, recovery, and recycling. That “encouragement” has consisted of a series of targets for recovery and recycling, coupled with financial penalties for non-compliance.

U.K. Milestone Ruling on Release Liners

Until this year, release liners were classified as process waste, but current thinking is moving toward the idea they are, indeed, packaging waste. The British government already has taken this route, which could have serious implications for the U.K.’s roll-label industry, as it attempts to compete with European neighbors while shouldering the financial burden of responsible liner waste disposal. The U.K.’s decision undoubtedly will affect thinking across Europe and the world as a whole. France is indicating it is likely to take the same stance as the U.K.

This shift will have consequences across the supply chain in relation to release liners. The release liner manufacturer and laminate manufacturer necessarily create waste during production. The label printer creates waste during conversion—offcuts and trim. The packaging manager is left, after label application, with release liner for disposal. All may be held responsible for the liner waste at their premises.

New Recovery/Recycling Targets in Pipeline

A revised set of EU recovery and recycling targets is due later this year. They will be much more severe than the originals, yet many countries in Europe still fail to comply with the original requirements. While the EU targets apply across all member countries, implementation is the responsibility of the individual countries.

Waste Management Infrastructures

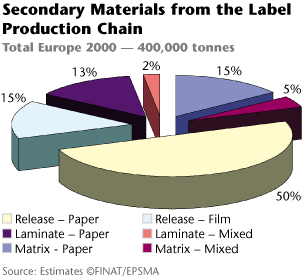

FINAT, the international self-adhesive labeling association based in the Netherlands, along with the European Pressure Sensitive Manufacturers Association, is spearheading an initiative to “wake up” the individual EU countries to the need to develop waste management infrastructures—matrix, release liner, and unused laminate. FINAT is active in helping the industry in Europe find companies able to collect, recycle, and recover label by-products and in providing technical assistance in setting up such schemes.

A few EU countries, particularly Germany, have strong, established waste management networks across the whole packaging industry, including the self-adhesive label industry in relation to release liners. However, most countries have taken few or no steps toward implementation. Many countries do not even have fully-established waste management infrastructures to enable recycling and recovery, let alone documentation of levels achieved.

Proposed EU Targets

Discussions affecting the packaging industry as a whole go on in the European Parliament, and there is no consensus on what the revised targets should be. Current proposals involve 55%–80% recovery of all materials—including release liner where it is classified as packaging waste—and different recycling targets for glass (60%), paper (60%), metals (50%), and plastics (22.5%). Agreement on a final legally binding document is not expected before year end.

Environmental Responsibilities

Environmentalists argue there is no good reason why the self-adhesive label industry should delay in positioning itself to meet the challenge of the EU legislation. The fact remains there is no need for release liner disposal in landfill sites or by incineration without energy recovery. Legislation like the EU Packaging and Packaging Waste Directive, with its attendant financial penalties, has driven change in Europe’s packaging industry, but it also could be considered the moral responsibility of the industry, both in Europe and across the globe, to face the issue fairly and squarely on its own.

Some schools of thought say the benefits would be twofold. First, it would be environmentally responsible to put in place a Europe-wide waste management infrastructure that would optimize the reuse and recycling of release liners. Second, such an industry-specific initiative could create a “level playing field” in the European self-adhesive business arena and help maintain a platform for profitability in an industry where margins are heavily under pressure.

The Bottom Line

The bottom line is profitability for the whole supply chain—and it is worth remembering that waste management firms like US-based Channeled Resources and its MaraTech subsidiary, as well as Ahlstrom Werk in Germany, have proved it is possible to recover, reuse, and recycle film and paper release liner—and to make a profit while doing so.

Visit AWA at awa-bv.com.

Part 1 | Part 2 | Part 3 | Part 4 | Part 5