Mergers & Acquisitions | 2017 Year-End Review

- Published: January 08, 2018, By Mesirow Financial

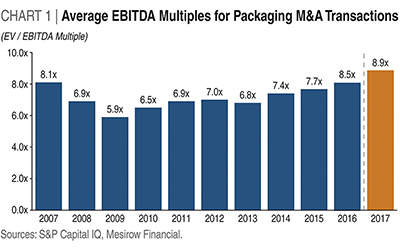

Mesirow Financial reports average EBITDA multiples for packaging transactions grew to a record 8.9x.

The prime storyline of 2017 is the subject of valuation. The three major market indices indicative of U.S. financial strength – Dow, S&P 500, and NASDAQ – all hit record levels. Similarly, many dominant U.S. corporations thrived in 2017; Apple exceeded $900 billion in market capitalization while Amazon’s price/earnings ratio grew to over 200x trailing earnings. Meanwhile, the economy’s overall robustness was further demonstrated through luxury item valuations; Leonardo da Vinci’s “Salvatore Mundi” sold at auction for a record-breaking $450 million, which was over 4x the pre-sale estimate of $100 million. This theme was upheld with packaging M&A transactions as seen with the average EBITDA multiple, which grew to a record 8.9x (see Chart 1).

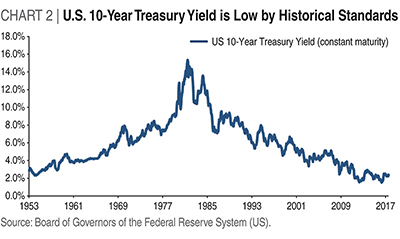

The unquestioned driver of valuations is the economy operating in a world of lowered rate of return expectations. Asset owners simply do not expect to earn the same rate of return on assets as they did five, ten, and certainly not 30 years ago. Chart 2 tracks the yield on the 10-year Treasury bond over the last 64 years. It clearly demonstrates the massive economic forces that have reshaped the world since the early 1980s – the rise of globalization (especially in China), the demise of inflation, the lessening importance of the commodity complex, and the growing importance of coordinated monetarism.

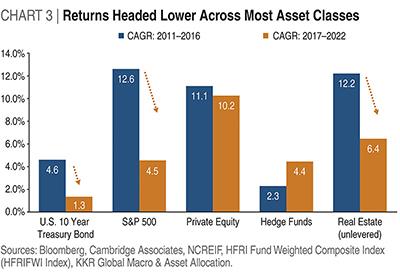

The net result is a fundamental change in investor outlook. Chart 3 gives a perspective on expected rates of return across four important asset classes. Based on these expectations, investors will bid up the value of opportunities within those asset classes. It is interesting to note the expected rates of returns for private equity have declined, but the appeal of the asset class to investors is still readily evident and is the primary reason private equity fundraising remains strong.

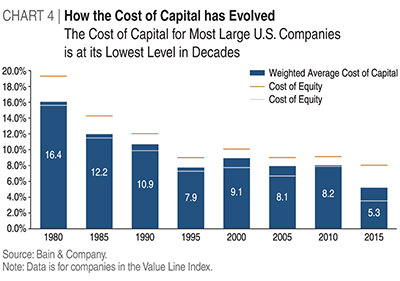

At a corporate level, the world of lowered rate of return expectations is manifested in lower costs of capital. Chart 4 highlights the dramatic decline in the cost of capital since 1980. This phenomenon readily explains the super-cycle of M&A that exists today on a global basis, as well as the notable capacity-increasing investments of companies like Amazon, Alibaba, Tesla, and many others.

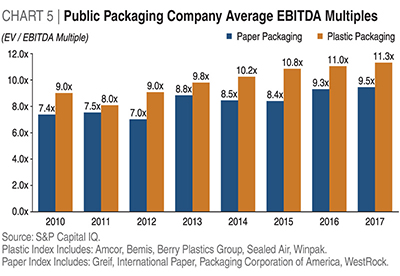

The packaging world, as expected, continues to be influenced by these macro-economic forces. As demonstrated in Chart 5, both paper and plastic packaging stocks are trading at record valuation levels.

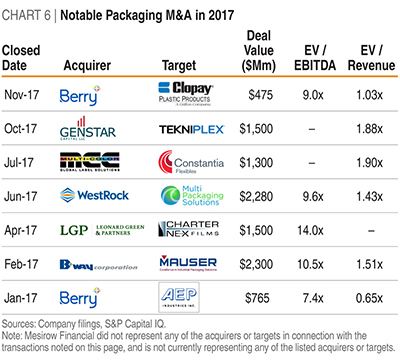

The effect of this resultant low cost of capital environment is seen in both 2017 notable packaging M&A transactions (Chart 6) and in recent announcements such as Pratt Industries’ investment of $500 million in a new domestic paper mill. These notable transactions include several private equity led transactions, not surprisingly, given recent history.

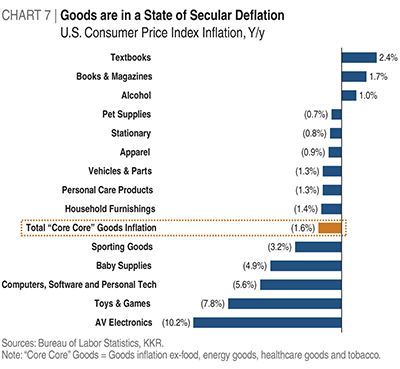

Industry participants often ask how long this environment of lofty valuations will last. A large contributing factor to the decline in rate of return expectations has been the muted impact of inflation. Chart 7 details a component analysis of inflation from mid-2017 until now. Until that dynamic changes significantly, it is hard to imagine any dramatic shift in the investing environment.

Outlook for 2018

For any observer of the stock market, it is relatively easy to conclude that globalism – for all of its strains on economies – has been a strong net positive for the investment world. Standards of living, as well as profits, have been increasing across the globe, resulting in a positive force for M&A activity. Protectionism has an appeal, but there would most likely be a cost to economic growth, valuations, and the M&A market. In the meantime, it is easy to be optimistic about M&A and valuations across most industries, certainly packaging.