Working Undercover

- Published: July 01, 2007, By By Corey M. Reardon AWA Alexander Watson Assoc.

Brand Security

Click HERE for brand protection products.

Approximately 5%–7% of the world’s trade is in counterfeit goods, so it probably is true to say that counterfeit goods are one of the world’s biggest brands—brands that compromise human health and safety as well as legitimate brand owners’ businesses. The size of the problem is well illustrated by the FDA’s estimate that 7% of all drugs sold in the US are counterfeit.

Overall, counterfeiting costs US businesses $200 billion–$250 billion annually. These figures are estimates—and presumably conservative—as no one really knows the true extent of counterfeiting above and beyond these statistics.

Case History: Auto Components

The automotive components industry is an example that combines both the elements of brand integrity and human safety issues. The Motor and Equipment Mfrs. Assn. (MEMA) has battled counterfeiting for years. Counterfeit parts initially came from Japan, but today China, Eastern Europe, and India are all major sources, and the problem definitely is worldwide now.

Auto component look-alikes are difficult, if not impossible, to identify from the real thing, and a simple failure in a fake auto oil filter can lead to expensive engine repairs that typically will not be covered by insurance or warranty.

Like other leading industrial companies, Ford addresses the problem by single-sourcing the development of all its labels and packaging, coupled with extensive undercover operations, to monitor the spare parts market. The estimated annual cost to the company of counterfeiting and piracy is about $1 billion excluding health and safety issues.

Brand Protection Brings Benefits

It is hardly surprising that genuine brand manufacturers—whether for cosmetics and perfumes or auto and airplane parts̵are taking every possible step to protect their products. Increasingly, they are doing so not just through “policing” their manufacturing and distribution chain but at the single-item level via a product’s packaging and particularly its label.

With most brand owners in the high-value goods sector choosing to use multiple levels of security on their products, there are strong opportunities for the converting industry to contribute custom-engineered solutions in a non-price-sensitive market. Cost is not an issue where brand integrity is concerned. According to research conducted by the US Chamber of Commerce’s Coalition against Counterfeiting and Piracy (CACP), implementing a brand protection strategy can bring real business benefits in different ways. The majority of respondents cited the successful use of authentication technologies to apprehend counterfeiters. Consumer confidence in the integrity of the brand increased, and of course, bottom line profitability also increased.

Using Self-Adhesive Laminates

The available technology platform is extensive, but the self-adhesive label has proved itself a leading carrier for product authentication and product security technology, whether overt or covert. CACP estimates 76% of all product security applications involve the label.

The physical nature and the flexibility of the self-adhesive “sandwich” provide plenty of options for accomplishing this. Security devices can be included visibly on the label face in the form of holograms, other optically variable devices (OVDs), or printed security devices. Invisible messages, readable only via special equipment, also can be added to the label facestock as an integral surface coating—and, of course, underneath it, in the adhesive layer, and even under the adhesive layer.

Leading self-adhesive laminators already are active in creating customer-specific security labeling solutions. They also are working with a broad base of suppliers of both raw materials and security devices and technologies as well as with converters to define and meet the needs of particular brand protection challenges.

Science today has created a wide spectrum of opportunities to provide unique identifiers. They range from DNA and nano-taggants to infrared-readable metal and nylon “threads” and, of course, radio frequency identification (RFID) antennae and other “smart” options.

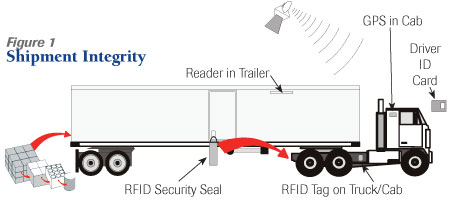

While RFID is a track-and-trace technology as opposed to a mainstream brand security device, it can play a strong role in tracking goods in transit. It’s a market that AIM Global, the Assn. for Automatic Identification and Mobility, is keen to promote. Maintaining shipment integrity for sensitive goods such as pharmaceuticals requires a combination approach. It can include, for example, RFID tags on the vehicle, a driver identification card, and a global positioning system (GPS) (see Figure 1).

Top users of RFID today are the automotive market, both at OEM and aftermarket level, consumer packaged goods, and retailers. Strong market development opportunities also exist in many other areas, including medical identification and postal tracking, as prices continue to drop.

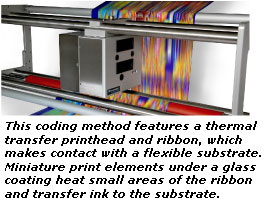

RFID tags often are described as “electronic bar codes,” and the older technology of the thermal-transfer-printed bar code should not be forgotten as a track-and-trace security aid. The US FDA Counterfeit Drug Task Force states that the requirement for an e-pedigree for a pharmaceutical product either can be achieved via RFID or bar codes.

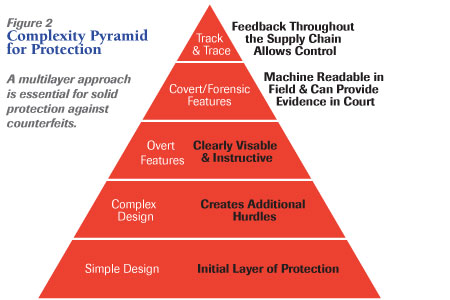

Advanced multilayer authentication solutions—overt, covert, and forensic—are available for thermal transfer print as for other print processes (see Figure 2). The inkjet cartridge also can perform a valuable, low-cost security role when it is filled not with standard ink but with taggants, for laying down small, machine-readable “footprint” marks directly on a package or its label.

Food Safety & Retailing

Some advanced label stock materials in use today take the product security platform one step further. Self-adhesive labels on fresh food packaging can feature a time/temperature indicator, warning retailers and shoppers if the product has exceeded its safe temperature storage range at any time. They also can feature other freshness indicators that can signal to the cashier at the supermarket checkout that a product should not be sold because it is out of specification in terms of sell-by date or storage conditions. Such solutions are becoming a commercial reality in retailing now.

At exits, many retail outlets employ some form of electronic article surveillance to minimize inventory “shrinkage” through shoplifting. All the systems—electro-magnetic, radio frequency, and acousto-magnetic—rely on a sensor- readable tag that can be deactivated only at the checkout. All such tags require very tightly specified label solutions, often involving specialty label stocks.

At the other end of the spectrum, self-adhesive laminators also offer standard label stocks for tamper evidence such as “void” labeling, which leaves a message on the substrate when the label is peeled back. Other alternatives include highly frangible paper and filmstocks as over-the-cap seals on jars and bottles to provide instant, visible evidence of tampering.

Inks as Identifiers

Using a special security laminate or a standard label stock, today’s label converter can significantly enhance the product authentication properties of a label on a narrow web press using specialty inks. Fluorescent, photochromic, chemichromic, thermochromic, magnetic, and color-shift inks are just a few of the available choices from leading ink manufacturers contributing innovative security features that can be conveniently added to the print on a label.

A good example is the technique of printing a latent image on a predetermined position on the label, visible only through a special filter, with the help of color-shifting pigments in an overvarnish above the standard label print.

Additionally, of course, all the features of security print that have protected banknotes, postage stamps, passports, and other documents from counterfeiting can be incorporated into packaging or label print.

The Role of the Converter

The converter’s role in creating a brand authentication strategy involves a different approach than the normal sales approach. The converter often will be required to maintain confidentiality, both with suppliers and brand owners, and to maintain rigorous process controls.

Reviewing innovation in authentication solutions is important: A brand owner may change security devices used on a product, as well as layer technologies, to keep counterfeiters at bay. This is an area where a converter can act as a consultant.

Solution providers are well placed to support end-users and converters through organizations such as the Brand Protection Alliance, AIM Global, North American Security Organization, and CACP. Their collective voice says the key to success in beating counterfeiters is cooperation and supply chain partnerships.

At AWA’s 2006 Product Authentication and Brand Security Conference, Paul Fox, director of external relations for P&G Gillette, made a powerful “call to arms.” Counterfeiting, he said, is not a victimless crime: People are harmed by fake foods and drugs; corporate and brand reputations are placed at risk.

Companies must introduce authentication and brand protection strategies, and many of those strategies will be implemented by the converting industry.

Coding: A Digital Signature

By Edward Boyle, Contributing Editor

As marketing manager for brand protection solutions at Videojet Technologies, Jack Walsh knows a thing or two about product authentication. In the past 40 years, his company has installed more than 275,000 product coding machines worldwide that help manufacturers authenticate their raw material components and track the global distribution of finished goods.

And no crisis has dramatized the need for “cradle to grave” product protection more than the contaminated pet food that made its way into the supply chain last December and caused the death and liver disease of dozens if not hundreds of cats and dogs. Ultimately the contamination was traced to the undetected introduction of aflatoxin—a deadly substance produced by fungus that leads to severe liver damage if ingested—into the product produced by Diamond Pet Foods.

Walsh says that while more stringent ingredient monitoring may not have prevented the contamination—after all, they can’t test every raw material—it would have made it easier for Diamond and other manufacturers to deal with the aftermath.

“At the moment, the industry is struggling to determine who has unsafe product and what to do about it,” says Walsh. “In this case, someone counterfeited a product and got it into the pet food chain. Brand protection is about keeping track of what the manufacturers have control over, what went through their plants, and what they shipped off to customers. The supplies, materials, and ingredients that go into pet food—there’s no traceability there. They don’t know what they’re putting into their product.

“We could have helped the industry ensure that [pet food manufacturers] are dealing with authorized and authentic ingredients,” explains Walsh. “Once a problem was identified and the specific sources were known, the entire industry would have been better equipped to avoid or discard any of the tainted sources.”

Protecting Consumers

Product tampering first became part of the consumer conscience in 1982, when bottles of Extra-Strength Tylenol capsules, produced by Johnson and Johnson, were laced with cyanide. By the end of the crisis, seven people had died. Although the incident was a result of product tampering and not manufacturer neglect, it did result in the rise of tamper-evident packaging that helps protect consumers once a product leaves the manufacturing facility.

The use of coding equipment adds a level of security by allowing manufacturers to give every product a “digital signature,” akin to a car’s license plate, that is unique to each of the millions of identical products that are mass produced and affect the health and subsequent confidence of consumers and expose manufacturers to the greatest liability. Simply, says Walsh, “We give them ways of authenticating their product.”

Using such systems, the manufacturers of pharmaceuticals, nutraceuticals, food and beverages, and others can track their products through the major steps in the distribution process and speed targeted recalls, since both the component and subsequent batches can be identified by unique tracking codes.

“Most of the customers simply need a visible code,” says Walsh. “There’s a background system for logging and tracking these codes. As each event occurs, when it’s shipped to the distributor or whipped through the chain, those things are recorded.”

Coding application systems often are used among layers of security: laser and thermal transfer marks, covert inks, specialty fonts, foil stamps, and holograms, making it difficult to duplicate.

“The thing that makes (coding) work is that every product can get a unique ID on the consumer level,” says Walsh, which most converters cannot do with their standard equipment. “They need equipment that can print digital data at press speeds” and not duplicate the codes.

Walsh says there are several levels of concern, including counterfeiting, theft, and label accuracy. Counterfeiting is a lesser concern than process documentation because it is beyond the manufacturer’s control and thereby negates liability.

“When I got into brand protection, I couldn’t stop talking about counterfeiting,” explains Walsh. “Once something becomes a brand, people are willing to buy it. It’s easy to move the product. So, the bad guys come in and say, ‘People buy Levi’s. How can we make money off it?’ We can’t prevent counterfeiting, but we can help customers authenticate their brand.

“Now that I’ve talked to thousands of customers, counterfeiting is not the problem they’re really concerned about. They’re all keen on protecting that supply chain and that brand. Most consumers can see and smell knock-offs, and the brand is not really liable. Gucci is not concerned because it’s so obvious.”

Although the use of coding technology has not reached the point where consumers can confirm the authenticity of a code, it’s coming. “I don’t know how long it’s going to take,” says Walsh, “but at some point in the future the consumer will be able to…confirm [a product] came through an authorized distributor. The consumer aspect is there to be taken advantage of, but no one has done it yet.”

SUPPLIER INFO:

Videojet Technologies—PFFC-ASAP 394. videojet.com

Coming in October: PABS07

AWA Conferences & Events, along with the Brand Protection Alliance, will host PABS07 North America, the product authentication and brand security conference, in Washington, DC, October 4–5. Papers span topics from in-depth, market-specific case histories to technical presentations on innovations in overt and covert security devices.

For more information visit awa-bv.com.

Click HERE for brand protection products.

Corey M. Reardon is president/CEO of AWA Alexander Watson Assoc., Amsterdam, Netherlands, a market research firm specializing in packaging. Contact him at +31 (20) 676 20 69.