FPA: The State of the U.S. Flexible Packaging Industry

- Published: March 11, 2024

By Dani Diehlmann, Vice President Communications, FPA

The Flexible Packaging Association’s (FPA) recently published annual State of the U.S. Flexible Packaging Industry Report provides industry converters, suppliers, investors and analysts with insight into the performance of the U.S. flexible packaging industry over the past year. This definitive source of data and information also examines several other aspects of the industry including:

- Performance (growth, revenue/volume expectations, profitability, capital spending)

- Materials and processes (printing, expected material usage)

- End-uses (end-use forecast, U.S. Census Bureau retail segments data)

- Structure and consolidation (merger and acquisition activity)

- Imports and exports (trade outlook)

- Industry vision, challenges and critical issues.

The report covers the entire flexible packaging industry, including the segment of the industry that adds significant value to flexible materials, usually by performing multiple processes. This segment of the industry was estimated to be $34.3 billion in 2022 and does not include retail shopping bags, consumer storage bags or trash bags.

U.S. Flexible Packaging Industry Performance

The total U.S. flexible packaging industry was estimated to be $42.9 billion in annual sales for 2022, an increase of 15.3 percent from the recalculated $37.2 billion

in 2021. The economic analysis group, Inforum, retained by FPA, estimates that the flexible packaging industry will grow to $44.7 billion in 2023, for a growth rate of 4.2 percent; and estimates that the flexible packaging industry will grow to $50.6 billion by 2027, for a CAGR of 3.3 percent from 2022-2027.

Flexible packaging represents 21 percent of the total $180.3 billion U.S. packaging industry and is the second largest packaging segment behind corrugated paper at 22 percent. Over 85 percent of survey respondents experienced higher growth in 2022 than in 2021 — with 86 percent expecting higher revenue in 2023.

In an analysis of 2022 flexible packaging shipments by NAICS groupings from the U.S. Cen sus Bureau, the largest category related to flexible packaging is the area of “Plastics Packaging Film and Sheet (including Laminated) Manufacturing,” which made up about $16.1 billion in 2022. This was followed closely by “Plastics Bag and Pouch Manufacturing” which generated $14.9 billion in value.

Materials and Processes

Flexible packaging companies utilize several materials and processes to produce flexible packaging. Films and resins accounted for the largest spend for converters with the two categories making up over two-thirds of material purchases — films are 47 percent; resins are 23 percent. Within films, polyethylene remains the dominant material, with 96 percent of converters responding to the survey saying they use PE. Polypropylene and polyester are the next most frequently used categories.

According to the report, printing, bag/pouch making, laminating and stand-up pouch production remain the most common processes done by converters with more than 75 percent of converters saying they perform those processes. Other processes such as coating, extrusion and labeling, among others, help converters differentiate themselves from their competitors. While not cited as a specific process, sustainability capabilities and the ability to handle and provide unique materials that include post-consumer recycled content, bio-based or paper-based substrates, will further allow converters to differentiate themselves.

In looking at flexible packaging structures sold by survey participants, “Rollstock” remains the dominant format produced by converters with 96 percent saying they produce that format, accounting for 57 percent of dollar value and by far the largest category, as has been the case in past years. Rollstock uses include primary product filling, secondary/sleeve wrap, bundling and overwraps.

“Premade, Stand-up, Non-re- tort Pouches” is the next most prevalent category, produced by close to one-half of survey respondents, followed by “Premade, Lay Flat, Non-retort Pouches.” While the two premade formats are produced by many survey respondents, their actual value of total production is much smaller (6-8 percent) for each format. Most other categories were produced by fewer than 20 percent of converters showing they may be more niche products.

When looking at the type of products that are used in the rollstock category, the “Bag & Pouches, Stand-up, Non-retort” format is the leader in both participation (67 percent) and the highest overall dollar value (23 percent). “Bag & Pouches, Lay Flat, Non-retort” is the only other rollstock category also produced by over half of survey respondents and with the same value at 23 percent. These were the two leading categories from last year’s survey, having just switched the top position.

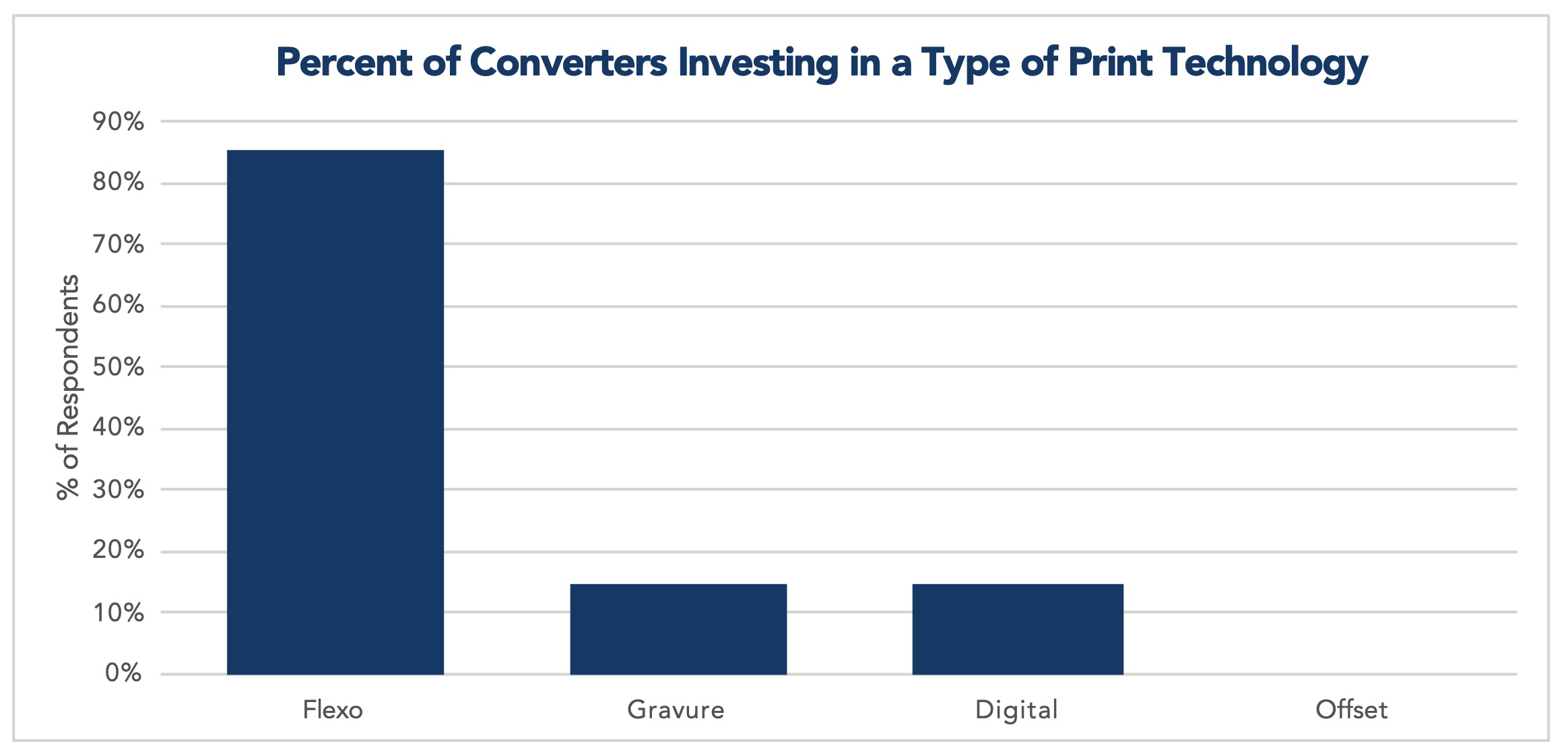

On the printing side, flexography continues to be the most prevalent technology, accounting for 72 percent of all shipments, followed by 15 percent of items shipped as unprinted and 12 percent using rotogravure. Digital printing continues to make inroads, albeit slowly as it still accounts for under 1 percent of all shipments, but 23 percent of respondents claim to have digital printing capabilities. When looking at where converters are making future printing investments, 85 percent said in flexo, while 15 percent cited investments in gravure and the same, 15 percent, in digital printing.

Data Sources

FPA gathers the information contained in the report through several reliable industry sources, including the FPA members’ State of the U.S. Flexible Packaging Industry Survey; the FPA non-members’ Industry-Wide Converter Survey; the Annual Survey of Manufactures (ASM), published by the U.S. Census Bureau; the U.S. Department of Labor; the U.S. Department of Commerce; industry analysts and investment banking reports.

Data collected from these sources provides a more complete picture of the U.S. flexible packaging industry and helps to crosscheck information regarding industry size, structure, market segments and key packaging products. The report is available to all members and is available for purchase by non-members.

About the Author

Dani Diehlmann is the Vice President of Communications for the Flexible Packaging Association and has over 20 years of experience in the flexible packaging industry.